Welcome to our in-depth guide on Solana mining. You’re in the perfect place if you’re looking for steps on how to tackle Solana mining. Yet, it’s key to remember that mining Solana isn’t quite the same as mining Bitcoin.

Solana uses a proof-of-stake (PoS) system, not the typical proof of work (PoW). So, instead of miners, Solana relies on validators and delegators. They help keep the network running smoothly and earn rewards.

Validators are super important in the Solana world. They create new blocks and check transactions. This keeps the network safe and efficient. Delegators, on their part, help in the consensus process by delegating their Solana coins to a validator.

If you want to start staking Solana and make some rewards, you’ll need to follow some steps. These include making a stake account and picking a validator. Our guide will help you at every step, from setting up your account to finding the best validator for you.

In the next parts of our guide, we’ll go into more detail on how to stake Solana. And how to choose the best platform for it. We’ll give you all the details you need to succeed as either a Solana validator or a delegator.

How to Stake Solana to Earn Rewards

Staking Solana lets you earn passive income by helping the network. You earn rewards by checking transactions. This guide will show you how to start:

- Create a stake account: Put your SOL tokens in a wallet like Phantom, Solflare, or Sollet.io. Then, make a new stake account with your tokens.

- Choose a validator: Pick a good validator for your SOL tokens. Validators make new blocks and check transactions. Look at their uptime and reviews before choosing.

- Delegate your SOL tokens: Follow your wallet’s steps to give your tokens to a validator. This helps them have more say and shows you trust their decisions.

- Start earning rewards: After delegation, you’ll get rewards automatically. You can see these rewards in your wallet from time to time.

Keep an eye on your validator to maximize rewards. Your earnings depend on their fee, the staking rate, and network inflation. Use calculators from Binance or Coinbase to see potential rewards.

When staking Solana, you must decide between easy use and control. Platforms with custody are easy but give you less control. Wallets without custody give you more control but are harder to set up. Also, know about lockup times when you can’t get your tokens back. Finally, consider fees from transactions and the validator’s take.

These steps and tips will help you stake Solana and get rewards. This helps Solana grow too.

| Factors | Description |

|---|---|

| Current staking rate | The percent of SOL tokens staked affects rewards. More staking means less reward for each because of competition. |

| Amount staked | The total SOL tokens staked. More tokens staked means smaller rewards for each person. |

| Validator commission | Validators take some rewards as fees. More fees mean less money for you. |

| Network inflation | New SOL tokens make each one less valuable. High inflation can lower staked token value. |

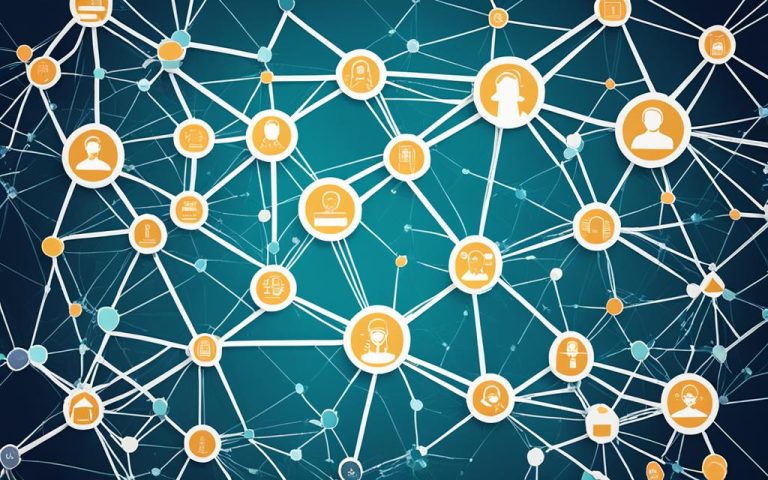

Staking on Solana can be direct or by delegating. Delegators share the validator’s rewards. Validators pay 1.1 SOL per day to the network.

With about 2000 SOL staked for ten years, you might make a million dollars. The staking yield is around 5.01% per year.

Staking Solana is a great way to make passive income and help the network. It’s worth looking into.

For more details on staking Solana, see these resources:

- A Comprehensive Guide: How to Mine or Stake Solana to Earn

- Solana Staking Official Documentation

- How to Stake Solana: Step-by-Step Guide

Choosing the Right Platform for Staking Solana

Choosing where to stake Solana is key for the best experience and rewards. Each platform offers unique benefits and things to think about.

Options include both cryptocurrency exchanges and non-custodial wallets. Each has its advantages and considerations.

Cryptocurrency Exchanges

Platforms like Binance, Gemini, Coinbase, and Kraken make it easy to stake Solana. They provide a simple process and a user-friendly interface to work with.

They also offer extra tools like staking calculators and the ability to track your rewards in real time. You can trade your staked Solana without waiting. But, remember you’re trusting them with your Solana.

Non-Custodial Wallets

For those wanting more control over their Solana, wallets like Phantom, Solflare, and Sollet.io are great. They offer potentially higher rewards too.

These wallets let you keep your private keys, giving you full control over your funds. They come with added security features, like support for multiple signatures.

The staking process might be a bit more complex than on exchanges. However, they offer higher rewards and a decentralized approach.

Factors to Consider

When picking a platform for staking Solana, think about these things:

- Security: The platform should protect your Solana and personal data well.

- Ease of Use: Make sure the interface is easy to use, especially for beginners.

- Supported Features: Look for useful tools like reward trackers and trading options.

- Community Reputation: Check what the Solana community thinks about the platform.

Considering these factors helps you pick the best platform for your needs.

| Platform | Features | Security | User Experience | Community Reputation |

|---|---|---|---|---|

| Binance | Staking calculators, real-time rewards tracking, trading options | High | User-friendly interface | Positive |

| Gemini | Staking calculators, real-time rewards tracking, trading options | High | Intuitive design | Positive |

| Coinbase | Staking calculators, real-time rewards tracking, trading options | High | Simplified user experience | Positive |

| Kraken | Staking calculators, real-time rewards tracking, trading options | High | User-friendly platform | Positive |

| Phantom | Multi-signature support, hardware wallet integration | High | Sleek and intuitive design | Positive |

| Solflare | Multi-signature support, hardware wallet integration | High | User-friendly interface | Positive |

| Sollet.io | Multi-signature support, hardware wallet integration | High | Simple and user-friendly | Positive |

Conclusion

This guide gave you all you need to know about mining Solana and another way to make money by staking. Solana may not offer traditional mining, but staking can be quite rewarding in the crypto world. By getting the basics of Solana’s network and learning how to stake Solana, you’re on your way to making passive income and helping the network stay strong.

Choosing where to stake Solana means looking at security, how much control you want, and ease of use. Keep up with how much you’re earning, how well your validator is doing, and any updates in the Solana network. This will help you make smart choices. Remember, staking Solana is a chance to join an exciting community and help this new cryptocurrency thrive.

Even though you can’t mine Solana, staking is a solid choice to get involved and get rewards. Step into Solana’s world and explore the benefits of staking your SOL tokens now!

FAQ

Can Solana be mined like Bitcoin?

No, you cannot mine Solana as you would Bitcoin. It uses a proof-of-stake (PoS) method, not proof of work (PoW).

How does staking Solana work?

By staking Solana, you earn money while helping keep the network secure and healthy. You create a stake account, pick a validator, and delegate your Solana tokens. This way, you start getting rewards.

How do I stake Solana?

Start by making a stake account. Move SOL tokens to your wallet and set up a new stake account. Choose a validator with good uptime, performance, and reviews. Then, delegate your Solana tokens to start staking.

Where can I stake Solana?

You can stake Solana on places like Binance, Gemini, Coinbase, and Kraken. Wallets like Phantom, Solflare, and Sollet.io also let you stake. Look at security, ease, and features when picking a platform.

Can I mine Solana?

No, you can’t mine Solana. But, staking Solana can earn you rewards and help grow and secure the network.

What should I consider when choosing a staking platform?

Think about security, how much control you have, ease of use, and what features are available. Exchanges make staking simple. Non-custodial wallets might offer more control and better rewards.

How can I monitor my staking rewards and validator’s performance?

Keeping an eye on your rewards and validator’s work is key to earning more. Most platforms and wallets have tools and dashboards for tracking your rewards and your validator’s status.